|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

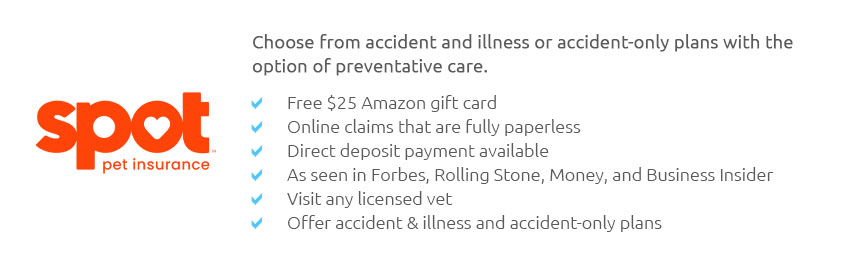

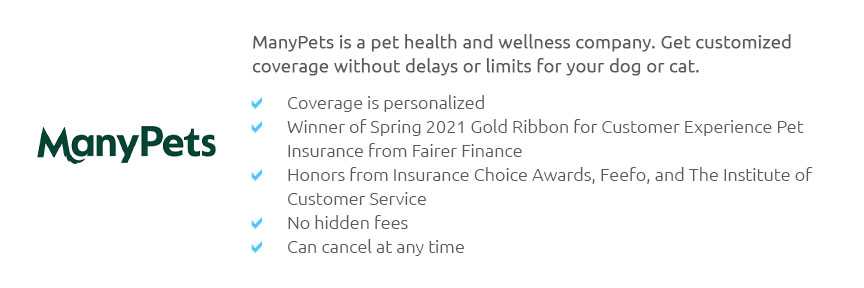

Insuring Your Dog: What to ExpectFor many pet owners, the idea of insuring a beloved canine is both intriguing and perplexing. As dogs have become integral members of our families, their well-being is a priority, making pet insurance a consideration worth exploring. This article delves into the nuances of dog insurance, helping you navigate the available options with clarity and confidence. Firstly, it's crucial to understand what pet insurance entails. Essentially, it's a policy that mitigates the financial burden of veterinary care. Like any insurance, it involves paying a premium, and in return, you receive coverage for a range of medical expenses. The scope of coverage can vary significantly from one policy to another, so it's imperative to scrutinize the details before committing. When considering insurance for your dog, one should be aware of the different types of coverage available. Typically, policies are categorized into three main types: accident-only, accident and illness, and comprehensive coverage. Accident-only policies, as the name suggests, cover incidents such as injuries from mishaps or unexpected events. Accident and illness policies, on the other hand, extend coverage to a wide range of medical conditions, making them a popular choice for many dog owners. Comprehensive coverage is the most extensive, often including routine care, vaccinations, and sometimes even dental care. It is also worth noting that the cost of insuring your dog can vary based on several factors. Breed, age, and even geographical location can influence premium prices. For instance, larger breeds or those prone to genetic health issues might attract higher premiums. Similarly, older dogs may be costlier to insure due to the increased risk of health problems. Living in an area with a higher cost of veterinary care can also affect the price. When navigating the myriad options, here are some key points to consider:

In conclusion, while insuring your dog is a personal decision, being informed about the various aspects and options can help you make a choice that aligns with both your financial situation and your dog's health needs. Insurance can offer peace of mind, knowing that you are prepared for unforeseen circumstances that may arise in your furry friend's life. As with any financial commitment, due diligence is essential, and understanding the fine print will ensure that you and your dog are adequately protected. https://www.progressive.com/pet-insurance/

Accidents and illnesses. Companion Protect and Pets Best offer plans that cover both injuries and illnesses, no matter how serious. These comprehensive plans ... https://www.usaa.com/insurance/additional/pet

As a USAA member or customer, you automatically qualify for 15% off your premium. If you have multiple pets, have a service dog, or are current or former active ... https://www.farmers.com/pet-insurance/

Protect the things you love most, including your pets. Farmers Pet Insurance plans through Pets Best start at $16/month. Get a free pet health insurance ...

|